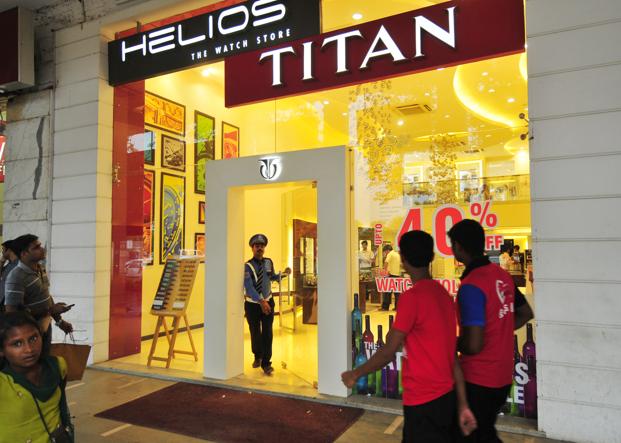

Titan argues 20% YoY revenue growth in the June quarter; first-quarter store additions of 68

Titan Company Ltd said it recorded a revenue growth of 20 per cent, year-on-year (YoY), in the June quarter of financial year 2023-24 (Q1 FY24). All key consumer businesses exhibiting double digit growth in the said quarter, the company stated in a post-market hours announcement on Thursday. A total of 68 stores were added (including CaratLane) during the quarter, Titan said, taking the retail presence to 2,778 stores.

Jewellery division delivered a satisfactory performance growing 21 per cent (YoY) in Q1 FY24. “Despite significant volatility in gold prices throughout the quarter, Akshaya Tritiya sales in April and wedding purchases in June were robust. The key categories of gold and studded grew well with no notable change in the overall product mix. New store additions, golden harvest and exchange programs continued to do well during the quarter,” Titan mentioned.

Watches & wearables division’s 13 per cent YoY growth comprised of 8 per cent growth in analog watches segment and 84 per cent YoY growth in wearables. “Brand Titan and international brands saw strong buying momentum clocking handsome doubledigit growths. Consumer preferences for premium brands resulted in good uptick in the average selling price for watches,” the Tata Group company said.

EyeCare Division saw sales growth of 10 per cent YoY. Titan also underlined that the trade & distribution channel grew faster than Titan Eye+.

In emerging businesses, Titan said fragrances & Fashion Accessories grew 11 per cent YoY driven by 9 per cent growth in fragrances and 13 per cent growth in fashion accessories. Taneira’s Q1 sales grew by 81 per cent YoY, it added.

In addition, CaratLane grew 32 per cent YoY driven with healthy contributions from multiple avenues.

Prabhudas Lilladher (PL) noted that the company’s jewellery performance was encouraging at a time when there was a significant rise in gold prices. “We believe that robust jewelry demand, improved mix & hallmarking benefits, expansion of 100 stores in eyewear in FY24, acceleration in store openings in watches and scale up in emerging businesses like Taneira and wearables will be major growth drivers for Titan,” the brokerage said.

Shares of Titan settled 0.18 per cent up at Rs 3,105.70 today, close to their one-year high levels. The stock touched a 52-week high of Rs 3,113.70 during the previous session.

PL has a ‘Buy’ rating on the stock with a target price of Rs 3,242, suggesting a potential upside of 4.20 per cent (calculated considering today’s closing levels).

The counter’s 14-day relative strength index (RSI) came at 79.96. A level below 30 is defined as oversold while a value above 70 is considered overbought. The company’s stock has a price-to-earnings (P/E) ratio of 82.67. It has a price-to-book (P/B) value of 22.99.

The scrip has a one-year beta of 0.84, indicating low volatility.

Meanwhile, Indian equity benchmarks scaled fresh closing peaks today. The 30-share BSE Sensex pack gained 340 points or 0.52 per cent to settle at 65,786, while the broader NSE Nifty added 99 points or 0.51 per cent to close at 19,497.